Model built for Handling a Large Payment of INR 1,000 is being Force-fitted on to a Micropayment of INR 10

Model built for Handling a Large Payment of INR 1,000 is being Force-fitted on to a Micropayment of INR 10

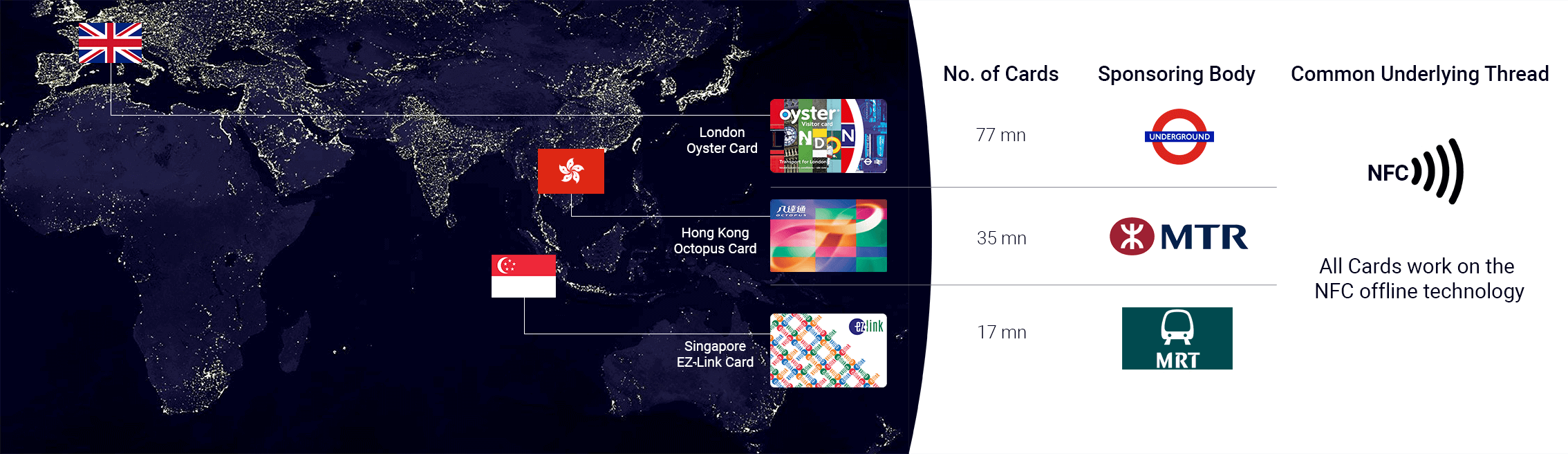

London Oyster

|

|

Hong kong Octupus

|

|

Singpore EZ-link

|

|

CityCash is a start-up company in the fintech industry bringing state-of-the-art technologies and unique business models in the digital payments space with a focus on NFC based card payments. Started as an initiative to make India ‘Less Cash’ and offer digital payments for everyone, CityCash designs, deploys and operates low cost offline and online payment technologies focused on the underserved space of high volume, low value payments.

Based in Mumbai, CityCash was founded in 2017 by veterans of the Investment Banking, Private Equity and Technology industries.

CityCash is a start-up company in the fintech industry bringing state-of-the-art technologies and unique business models in the digital payments space with a focus on NFC based card payments. Started as an initiative to make India ‘Less Cash’ and offer digital payments for everyone, CityCash designs, deploys and operates low cost offline and online payment technologies focused on the underserved space of high volume, low value payments.

Based in Mumbai, CityCash was founded in 2017 by veterans of the Investment Banking, Private Equity and Technology industries.

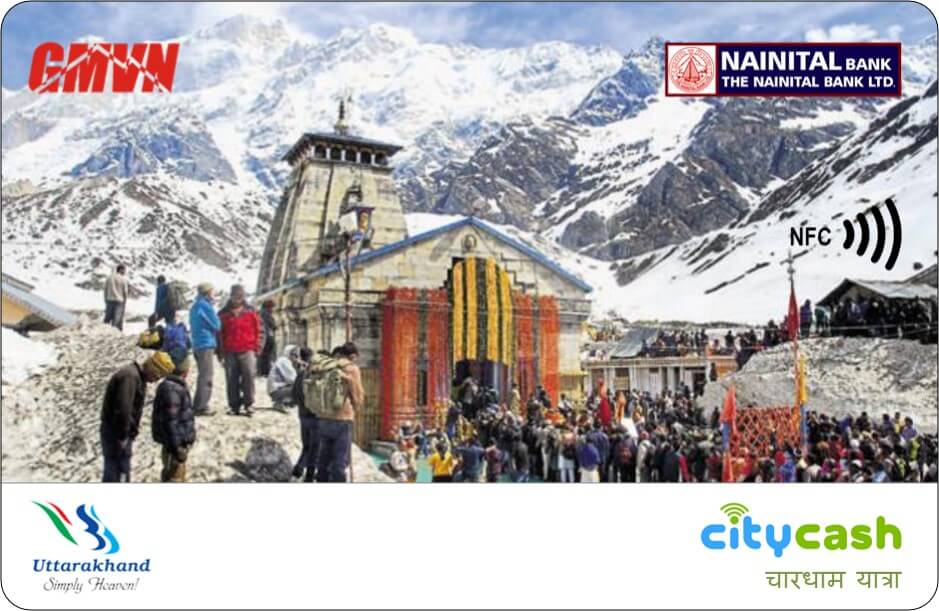

Unique Design and Iconic Imagery for Sense of Ownership to Citizens | Turning Financial Instrument into a Consumer Product

Maharashtra State Road

Transport Corporation

Bengaluru Metropolitan

Transport Corporation

Kedarnath -

Garhwal Mandal Vikas Nigam

Andhra Pradesh State Road

Transport Corporation

One of the cheapest entry level POS with robust, scalable technology and optimised performance

State-of-the-art and secure card technology with advanced encryption and global acceptance

Instant payment with zero failure without network dependence and user training

Card architecture with loyalty points packages and incentives offered by anchor merchants

Unlimited payments for a nominal, flat subscription for viable merchant

economics

Bank partnership to offer deep penetrated network of card issuance and loading points

One of the cheapest entry level POS with robust, scalable technology and optimised performance

State-of-the-art and secure card technology with advanced encryption and global acceptance

Instant payment with zero failure without network dependence and user training

Card architecture with loyalty points packages and incentives offered by anchor merchants

Unlimited payments for a nominal, flat subscription for viable merchant

economics

Bank partnership to offer deep penetrated network of card issuance and loading points

Public Transport

Tap to pay for tickets inside the bus and purchase of passes and packages at the bus depots

1Person-to-Government

Tap to pay for Municipal and SmartCity payments including for utilities, taxes, parking and tourism

2Mass Retail

Tap to pay for small value payments at kiranas, eateries, dairies, chemists and hawkers

3

Public Transport

Person-to-Government

Mass Retail

ICICI Bank Ltd is a leading private sector bank in India. The Bank’s consolidated total assets stood at ₹ 15 lakh crore at end of 2020. ICICI Bank's subsidiaries include India's leading private sector insurance, asset management and securities brokerage companies, and among the country’s largest private equity firms. It is present across 15 countries, including India.

Fino Payments Bank comes from an institution that, through its business correspondence network pedigree, has served the country’s banking needs for over a decade. It is the first payments bank to go live with 410 branches and more than 25,000 banking points in 499 districts across 28 states in India. Fino group is a thought leader, innovator and implementer of technology solutions for institutions like banks, governments and insurance companies.

Founded in 2012 by professionals from the mobile and fintech industry, Nearex is a fast growing fintech company providing a cashless payment technology for mass payments across emerging markets in Asia and Africa. Nearex is taking on the challenge of making electronic payments as simple and easy to use as cash, and affordable enough for the smallest merchant in any country.

ICICI Bank Ltd is a leading private sector bank in India. The Bank’s consolidated total assets stood at ₹ 15 lakh crore at end of 2020. ICICI Bank's subsidiaries include India's leading private sector insurance, asset management and securities brokerage companies, and among the country’s largest private equity firms. It is present across 15 countries, including India.

Fino Payments Bank comes from an institution that, through its business correspondence network pedigree, has served the country’s banking needs for over a decade. It is the first payments bank to go live with 410 branches and more than 25,000 banking points in 499 districts across 28 states in India. Fino group is a thought leader, innovator and implementer of technology solutions for institutions like banks, governments and insurance companies.

Founded in 2012 by professionals from the mobile and fintech industry, Nearex is a fast growing fintech company providing a cashless payment technology for mass payments across emerging markets in Asia and Africa. Nearex is taking on the challenge of making electronic payments as simple and easy to use as cash, and affordable enough for the smallest merchant in any country.

Recently RBI has announced that it would enable offline payments in retail on a pilot. Here is what our CEO had to say in today’s Economic Times about the recent announcement by RBI on offline payments through cards.

Story

Story

Moving towards our mission to digitize India's massive public transit ticketing and payment and creating an NFC card based offline Tap & Pay ecosystem for Transit & Retail.

Story

Story

Watch our Founder - CEO Vineet Toshniwal on how to Digitally Transform Public Transit system in India?

Video

Video

Our CEO Vineet in conversation with 'The Mobile Indian' how an offline mode of payment will help ease out and digitize small value transactions.

Video

Video

NFC-enabled , ‘Open Loop’ prepaid cards for transit ticketing.

Story

Story

Our CEO Vineet Toshniwal along with other industry leaders charts the growth path for #fintech, in CII's Fintech Innovation Summit “COVID-19 and India’s gravitation towards cashless economy”

Story

Story

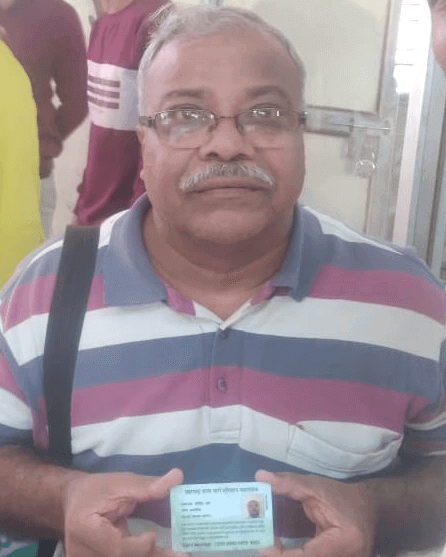

I Have been using the CityCash ST Card from July 2019. It has become easy for me to travel as I need not worry about carrying cash whenever I travel in ST bus. I just recharge my card on monthly basis and use it when required for buying ST Bus Ticket. Be it here in Nashik or in Pune or Kolhapur, I have got my Bus ticket without exchanging Cash

I read about this card in the newspaper, that all senior citizens will receive an additional 5% discount over and above of 50% discount to my Bus ticket. Being a retired person, Saving money is very important for me and this CityCash ST card helps me with the same

I stay in Pimpri and my college is in Pune. I have to travel everyday in ST bus. Earlier I had to present my pass as well as ID card to the conductor and it was cumbersome to take it out in a crowded bus as I have to keep the pass in the bag to avoid damage due to excess sweating. Last year I got a CityCash ST Card and now it is very easy, i just have to tap the card on the machine and it is done. Very easy. No need for separate ID card!

I have this monthly pass on my CityCash ST Card that I use to travel to my office daily, Its very easy and convenient to use to use, I need not worry everyday about keeping change for buying my ST Bus ticket and if sometimes my job requires me to travel to other locations I just need to recharge my card and use my same card to buy bus ticket

I run a xerox shop in Narayangaon near ST bus depot. I used to earn Rs 400-450 on a good day. I got to know about the ST card and got to contact through one of my friend for agency. Now, I do a daily registration and recharge of 40-50 people earning me Rs 400-500 daily other than my regular income from Xerox. Apart from this, twice i have benefitted from the offers run by the CityCash team winning a sum of approximately Rs 5000. I am satisfied as the extra income helped me renovate my shop and buy a new cooler.

Since the time this ST Card has been launched , the number of customers using this has gone up and my work of issuing tickets has been eased out. I need not carry change or count money any more. Everything is digitized.

74 Techno Park,

91springboard Unit No. 1.1,

1st Floor, 74/II, “C” Cross Road,

MIDC, Andheri East, Mumbai- 400093